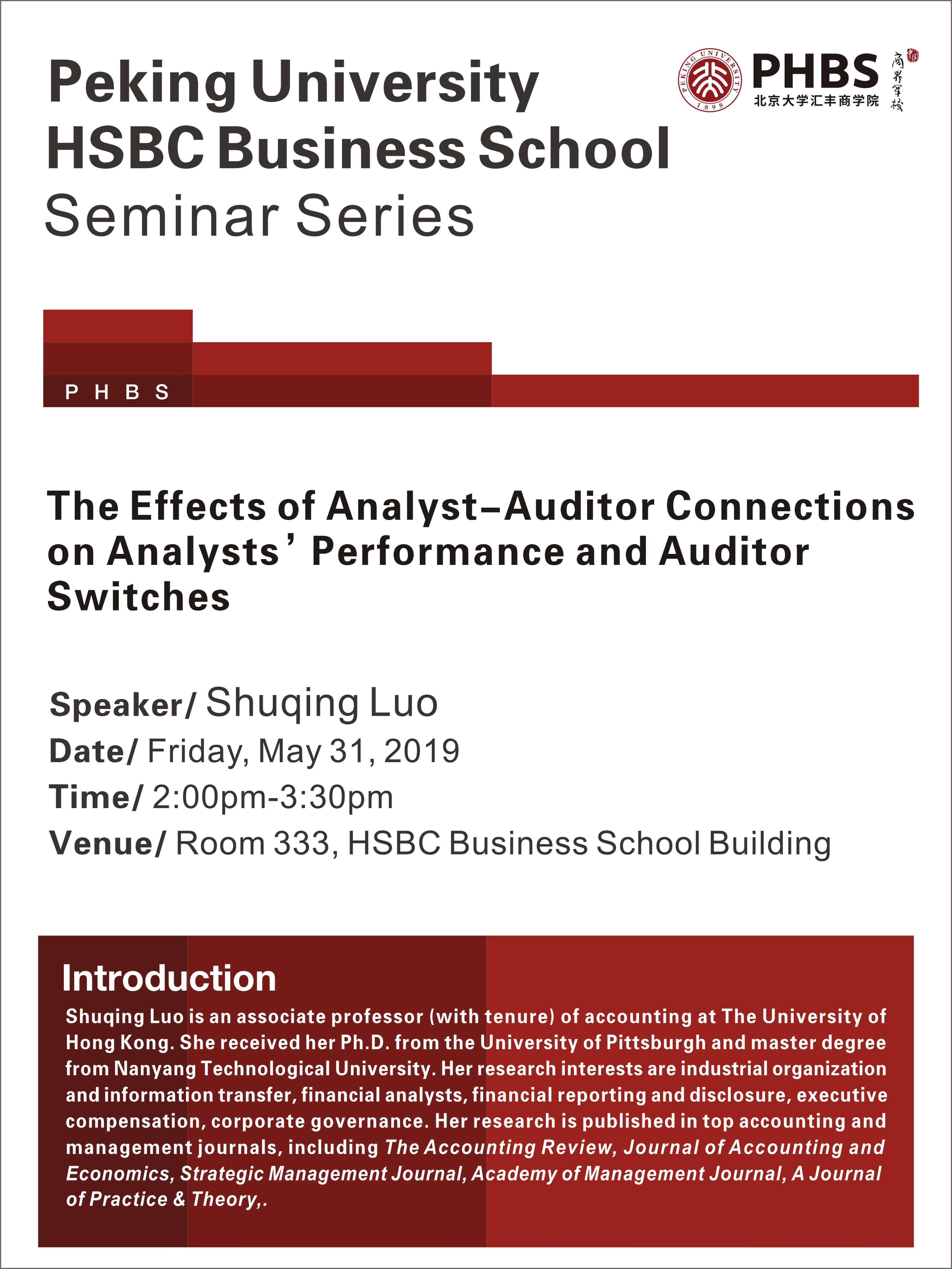

PHBS Seminar Series: The Effects of Analyst-Auditor Connections on Analysts’ Performance and Auditor Switches

2019-05-27 00:00:00

Speaker: Shuqing Luo

Date: Friday, May 31, 2019

Time: 2:00pm-3:30pm

Venue: Room 333, HSBC Business School Building

Introduction

Shuqing Luo is an associate professor (with tenure) of accounting at The University of Hong Kong. She received her Ph.D. from the University of Pittsburgh and master degree from Nanyang Technological University. Her research interests are industrial organization and information transfer, financial analysts, financial reporting and disclosure, executive compensation, corporate governance. Her research is published in top accounting and management journals, including The Accounting Review, Journal of Accounting and Economics, Strategic Management Journal, Academy of Management Journal, A Journal of Practice & Theory.

Abstract:

We examine the effects of school ties between analysts and the signatory auditors of the companies they cover. We perform our analysis on a sample of listed companies in China, where time-series information on school ties are available for analysts and auditors. We term analysts and auditors who attended the same university as “connected” when the analyst covers a company for which the auditor signs the audit opinion. We find that connected analysts issue earnings forecasts that are more accurate and less optimistically biased than those issued by other analysts following the same companies. This is consistent with auditors providing connected analysts with non-public information that improves analysts’ forecast performance. We also find that connected auditors are more likely to attract and retain clients that are covered by connected analysts. This is consistent with connected analysts reciprocating for the private information they receive (or anticipate receiving) from connected auditors. We further find that companies with connected auditor-analysts have better information environments and a greater likelihood of meeting or beating analyst forecasts prior to raising capital. We contribute to the literature by finding evidence of a novel channel through which analysts obtain information that improves their forecasting performance and through which auditors inform capital markets.